In Memoriam: Peter Carr

December 22, 1958 - March 1, 2022

A memorial service was held at the First Unitarian Congregational Society at 119 Pierrepont Street in Brooklyn Heights at 11:00 am on March 19, 2022.

In lieu of flowers, please direct donations in Peter's memory to the National Museum of Mathematics.

It’s relatively rare for anyone to have a scientific discovery, theory, or system named after themself, but when financial scholars study the CGMY model of pricing derivatives, the C is a tribute to Peter Carr.

Carr — whose many other honors included being named Quant of the Year by Risk Magazine and Financial Engineer of the Year by the International Association of Quantitative Finance, receiving the Cutting Edge Research Award from Wilmott Magazine, and landing on Institutional

Investor’s “Tech 50” list multiple times — generated buzz when he left the corridors of power on Wall Street to chair NYU Tandon’s Department of Finance and Risk Engineering (FRE) in 2016. He would, after all, be giving up an enviable job as Morgan Stanley managing director and global head of market modeling, with a lengthy CV that also included stints as head of equity derivatives research at Banc of America and head of quant research at Bloomberg.

Still, Carr, who had been a professor at Cornell early on in his career and later taught courses at NYU Courant for over a decade, was intent on helping to train a new generation of financial professionals — those ready to meet the burgeoning global demand for machine learning expertise, able to work with sophisticated modeling and information technology, and undaunted by job descriptions that would have been unimaginable even a decade before.

Carr attracted an impressive roster of financial practitioners as faculty members to FRE, which had launched in 1995 as one of the first such programs in the nation, and he set about establishing dozens of new courses on topics like automated differentiation; machine learning; cryptocurrencies and blockchain; cloud computing; and environmental, social, and governance (ESG) investing. Those efforts had tangible results: each year the FRE program rose in the rankings compiled by respected organizations like QuantNet and the TFE Times. Not given to boasting, however, Carr sometimes dismissed that accomplishment, preferring instead to measure his success by that of his students. He admittedly had great reason for pride on that score, as FRE graduates began following in his footsteps at iconic financial institutions, pushing the boundaries of their fields, and helping keep global markets functioning.

Born in Canada to Larry and Livia Caruana, immigrants from Malta, Carr had initially become interested in finance as a newspaper delivery boy, fascinated by the fluctuating U.S.-Canada exchange rates being reported each day. He took his first formal finance course while earning a bachelor’s degree in commerce at the University of Toronto, where he remained for his MBA studies. Tiring of Canada’s inclement weather, he then applied to doctoral programs only in California and landed at UCLA — a program he entered with some trepidation, since rumor had it that every doctoral candidate over the previous five years had failed a required comprehensive exam. That trepidation was unfounded: he not only passed but subsequently commenced upon a now-storied career.

At Tandon, despite the demands of chairing an important and dynamic academic department, Carr still found time to engage in his own research, and by 2022 he was ranked fourth in the world by Google Scholar in Financial Engineering citations, third in Quantitative Finance, second in Derivatives, and first in Volatility. Groups around the globe vied to secure him as a conference presenter or keynote speaker, and a single year could find him as far afield as Canada, Spain, and Australia. But while students and colleagues often marveled at his intellectual prowess and keen insight, it was his warmth, approachability, and genuinely caring nature that elicited the most admiration. A financial journalist once wrote of him, “Within a minute of speaking to Peter Carr you are put immediately at ease: despite the formidable resume and list of achievements. Twenty years in industry at Morgan Stanley, Bloomberg, BOA. Seminal work on variance and volatility. Awards aplenty. Carr doesn't have to be that nice, and yet he is.” (The impact he had on students, alumni, and others in his field is evidenced by the outpouring of online tributes).

“Working with Peter was a truly amazing experience,” said Acting Department Chair and Industry Professor Barry Blecherman. “He was a world-renowned thought leader – an intellectual giant. But in FRE all of that paled when compared with the fact that Peter was a nice person. He had time for everyone. He was always smiling and laughing. He was humble and friendly and approachable. And Peter gathered to himself other kind, empathetic, hard-working people. Our department became a family under his leadership.”

“NYU’s great strength rests in the excellence of its faculty, and Peter Carr, chair of Tandon’s Department of Finance and Risk Engineering, exemplified this,” University President Andrew Hamilton has written. “As a scholar, teacher, colleague, department chair, and business person, he was respected for his dedication, his talent and great gifts, and his leadership. NYU has lost someone not only very accomplished but also very much admired and liked. His death is a painful loss for NYU and particularly for the Tandon School, especially coming as suddenly as it has.“

“It would be impossible to overstate the esteem in which Peter was held, both at our school and in the broader financial world,” said Dean Jelena Kovačević. “Thanks to him, our FRE students are shaping the future of the entire financial industry, and they’re doing so with the benefit of his incomparable example. While he will be deeply missed by all who worked and studied with him, his legacy will long endure here. On a personal note, I will miss him deeply, his sense of humor, our shared love of math, and his innate generosity.”

The deepest sympathies of the entire Tandon community go to Peter’s wife, Carol; daughter, Olivia; and his entire extended family.

Memories from a close colleague

I met Peter Carr in 1987. I had just started my first full-time academic job, teaching finance at the University of Southern California. Peter was in his last year of graduate school at UCLA. He had been a professional accountant for a few years before going for his Ph.D., so he was a few years older than I. While at USC, I frequented the weekly UCLA seminar series across town, at a time when so many great financial minds were there — such as Richard Roll, Michael Brennan, Eduardo Schwartz, and Francis Longstaff, to drop a few names. Berkeley was not that far away, with Hayne Leland and Mark Rubinstein in residence. Peter and I became friends quickly, and we had common interests in derivatives pricing at the time. I had recently published a paper valuing insurance contracts by integrating the Black-Scholes option pricing model. I remember one day Peter told me he thought my formula was wrong, but a month later told me I was right after all. We had a healthy and fun academic relationship.

I tried to get Peter to interview for an Assistant Professor position at USC in 1988, but he had other ideas. He joined Cornell upon his graduation, and I went to Wall Street a few years later. I never left derivatives, building my career in commodity finance, financial risk management, security design, credit, and corporate finance. Peter specialized in derivatives theory and trading. He had a brilliant academic beginning, publishing an eye-popping work with Robert Jarrow on local time, which was a novel way to price the extrinsic value of an option based on how much "time" the stock price spent at the exercise price of the option in a continuous-time stochastic process. This was a brilliant mathematical insight, but I would have to say the practical value was more pedagogical. Peter continued to write prolifically, contributing to not only the theory of mathematical finance but also to the practice. Demand for his insight was increasing in financial circles. Peter started to become known in both academic and professional venues on the East Coast. We saw each other at conferences and industry dinners regularly, covering the globe.

Peter left Cornell for Wall St, but never lost the academic bug completely. He worked for hedge funds and trading companies like Susquehanna, but also held important roles managing groups of quants, at places as venerable as Morgan Stanley. He had a rare combination of academic curiosity, technical capability, personal humility, and a sincere desire to help others that made him an effective leader, an able contributor, a true collaborator, and an inspiration to many young quants. Through Peter's work, mathematicians and physicists were able to see immediately how they could apply their seemingly unrelated skills to financial problems. At NYU, Peter's ongoing work has become broader, some very applied and some very abstract. He has cultivated thankful Ph.D. students, co-authors, postdocs, and visiting faculty with a seemingly unending supply of academic energy.

Over the years I saw Peter at conferences and we kept in close touch with each others' work. When one of my consulting ventures failed, he was my first phone call. He had just joined NYU FRE as the chair. He needed someone to teach corporate finance, and I fit the bill.

At funerals I have often heard people say, "I would not be where I am were it not for the dearly beloved Mr. X." In my case, there is no truer statement I could make. Without Peter's encouragement and support, I would not be teaching at NYU Tandon. Without his excitement in converting an MBA finance course into a valuation course suitable for master's students in financial engineering, I would not have been able to create a brand new curriculum and write a book for the course. Without Peter Carr, I would not have been inspired to continue to publish new research in my 60s, a time when most academics are on to other things.

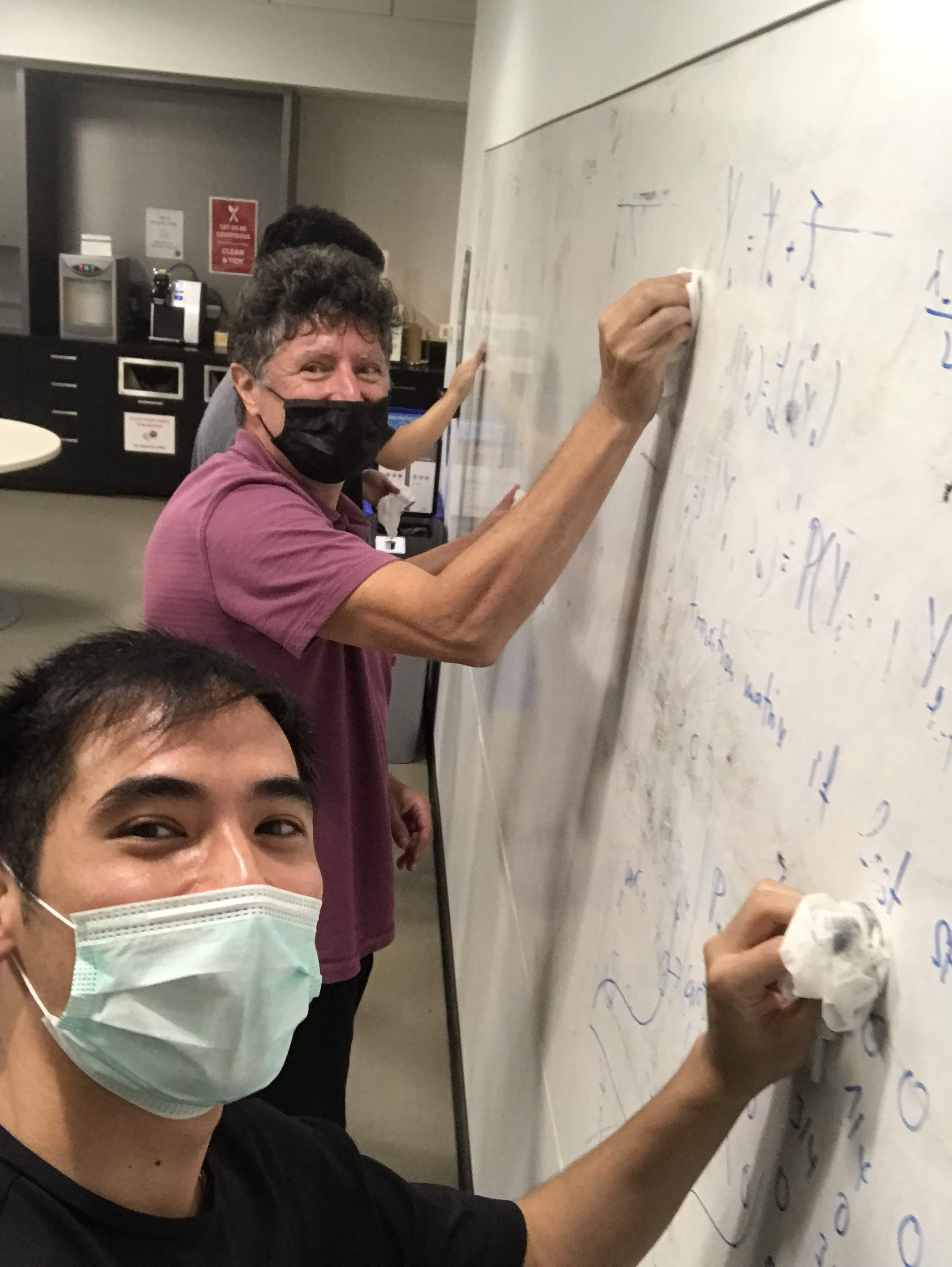

While working on my class and the book last summer, I discovered it was very difficult to teach option pricing to master's students who had never seen stochastic calculus before, and developed a new derivation that requires only college-level calculus. In disbelief, Peter asked me to prove it to him. I stood at the whiteboard outside his office and explained it... When I finished, he asked me to stop and held up his hand. After about a half-minute, he broke out in laughter, with a tear in his eye. How can it have been so easy? Why didn't we see this before? The proof remained unerased from his whiteboard for several weeks. He offered guidance and urged me to publish it immediately. The paper will likely appear this summer.

Anyway, I have proven my statement. Quod Erat Demonstrandum. Without Peter Carr, I would not be where I am today. I wish I could have thanked him more before he left us. I hope we can sustain and build on his unique and profound legacy. Now I am the one with the tear in my eye. May his memory be a continuous blessing for all of us.

— David C. Shimko, NYU Tandon Industry Professor of Financial Engineering

A student perspective

It took me a bit of time to gather my countless memories with my beloved professor, Peter Carr. He is one of the most significant persons in my life. He is like a father who provided the first light in my quantitative journey. He is a teacher, a mentor, a supporter, a neighbor, and a real-life role model. Could you imagine you would ever have a legendary financial figure who is down-to-earth, friendly, and willing to teach and support you? I am very fortunate that I once met a person like him. It is hard to picture my graduation ceremony without him standing alongside.

I first met Professor Carr during the Fall semester of 2020. I was fortunate enough to join a student club connected to the MSFE program at NYU Tandon that usually had a bi-weekly meeting with him. It is common to feel yourself being nervous before introducing yourself to him, especially when you know that he is a famous person. This happened to literally everyone. The opposite happened when you started introducing yourself to him, as he had never stopped initiating a conversation with you. He was very friendly and open-minded. He was always smiling and made people laugh at his jokes. His sense of humor relaxed everyone who had a conversation with him.

Because of his motivation and inspiration, I got involved on a research paper with him, even though he knew that my research experience was limited back then. He dedicated himself to teaching me in a research class for more than a year. He gave that opportunity to me, to his other students, and to everyone surrounding him. His good hopes drove me and others forward. He built people up. He trained thousands of quants for the industry. His passion inspired people, and he always wanted to see you getting better. By all definitions, he was a true leader and the one that I want to grow up to be. I could not and will never stop thinking about him during every accomplishment I make in the future.

I am very emotional about the loss, and I am sorry for everyone who shared similar experiences with me. My heart is with his family. MSFE at Tandon will never be the same, but it will keep growing. His legacy will continue, and we will make him proud.

He left on a jet plane that is never coming back again. However, I will always keep a picture of him laughing and cheering me from somewhere in a good place.

Rest In Peace Professor Peter Carr.

I am very grateful and very lucky to have met you.

You’ll always be my role model.

–Supavitch Nakburee

An alum remembers a tireless mentor

Peter was the smartest, funniest, and most supportive mentor a student could ever ask for. He showed me kindness even before I set foot in New York, when I was having problems with my scholarship for my master’s, and he remained a constant source of wisdom and inspiration throughout my stay there.

During my time at Tandon, Peter was my professor for two classes and the research advisor for my capstone project. One of my favorite things that he did during our weekly meetings for my project was just sitting in complete silence whenever he encountered a difficult problem. I always relished those moments and would always think to myself: I am seeing a genius at work. He usually came out of those silences with a great insight on how to answer the problem at hand, but he also sometimes ended up unable to find a solution during our session. The next day, however, I would find an email from him very early in the morning on how to answer the question.

Even after I graduated and returned to the Philippines, Peter offered to continue to meet with me weekly to prepare for my Ph.D. applications. He set aside hundreds of hours of his time for someone who was not even his student anymore. Even though we did spend most of our time talking about research, what I will miss the most from our Zoom calls were his stories about his time in academia, working on Wall Street, interesting YouTube videos and stack exchange entries, and the latest app or gadget that he had discovered that week. I will also miss his almost encyclopedic knowledge of mathematicians. (During one of our meetings last December, he even joked that he would also like a mathematical equation in his tombstone, like Ludwig Boltzmann. I did not know that this conversation would be relevant so soon.)

Thank you so much, Peter, for helping me pursue my dreams. It is heartbreaking to think that I am starting my Ph.D. journey without getting one final piece of advice from you. I hope you are in a much better place now and that I and all your former students can make you proud. We will miss you so much.

–JP Delavin (‘20)