Arbitrage Theory Via Numeraires: A Survey

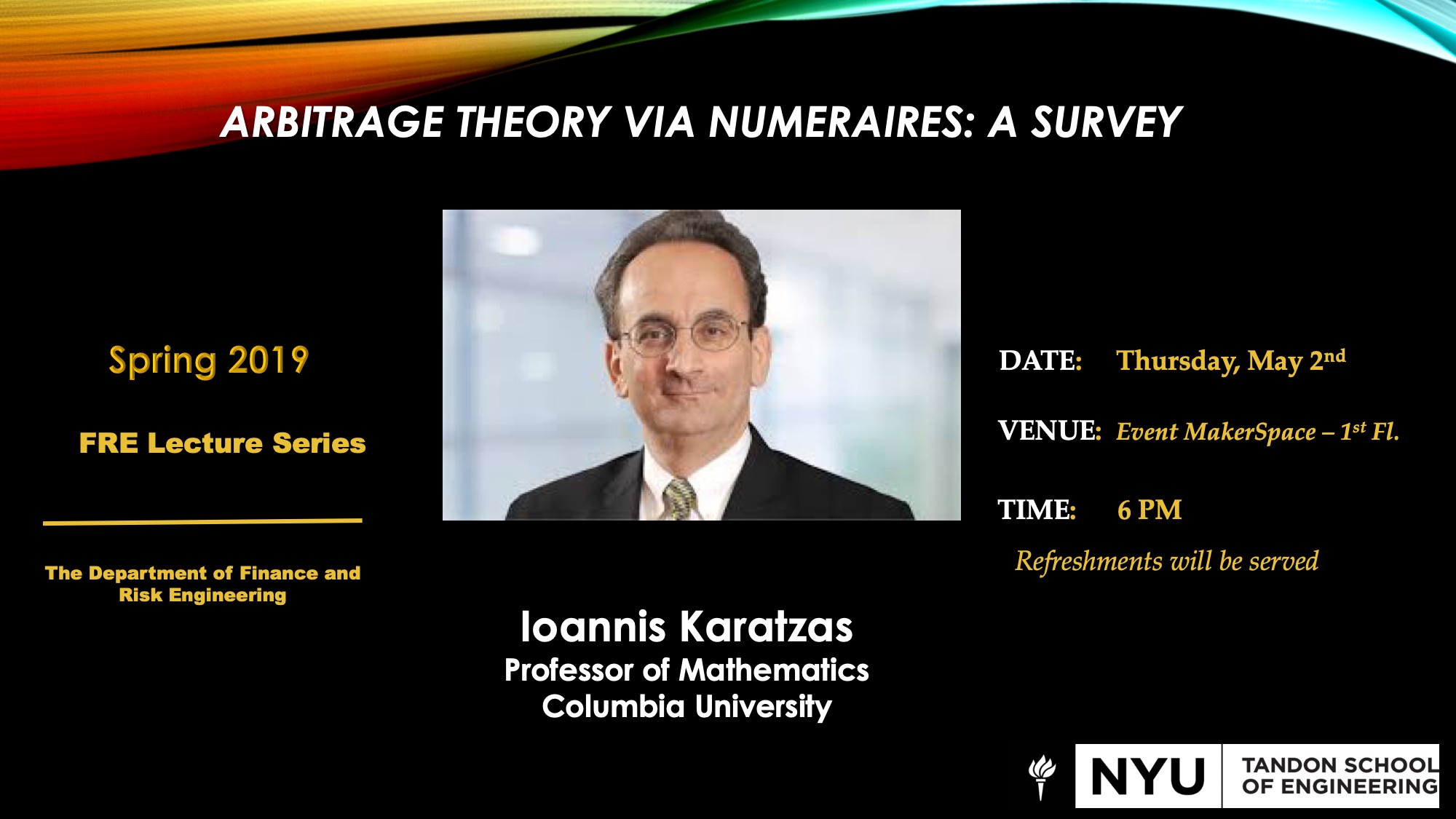

You are cordially invited to attend the final spring 2019 FRE Lecture on Thursday, May 2nd at 6PM in the Event MakerSpace. Dr. Ioannis Karatzas will present a talk on the following topic:

Title:

Arbitrage Theory Via Numeraires: A Survey

Abstract:

We develop a mathematical theory for finance based on the following “viability” principle: That it should not be possible to fund, starting with arbitrarily small initial capital, a nonnegative liability which is strictly positive with positive probability.

In the context of continuous asset prices modeled by semimartingales, we show that proscribing such egregious forms of arbitrage (but allowing for the possibility that one portfolio might outperform another) turns out to be equivalent to any one of the following conditions:

(i) a portfolio with the local martingale numeraire property exists,

(ii) a growth-optimal portfolio exists,

(iii) a portfolio with the log-optimality property exists,

(iv) a strictly positive local martingale deflator exists,

(v) the market has locally finite maximal growth.

We assign precise meaning to these terms, and show that the above equivalent conditions can be formulated entirely, in fact very simply, in terms of the local characteristics (the drifts and covariations) of the underlying asset prices. Full-fledged theories for hedging and for portfolio/consumption optimization can be developed in such a setting, as can the important notion of “market completeness”. The semimartingale property of asset prices is necessary and sufficient for viability, when investment is constrained to occur only along a discrete-time schedule and to be long-only — i.e., to avoid negative positions in stocks, and never to borrow from the money market.

When a strictly positive martingale (as opposed to local martingale) deflator exists, so does an equivalent martingale measure (EMM) on each time-horizon of finite length. We show that EMMs need not exist in a viable market, and that this notion is highly normative: Two markets may have the exact same local characteristics, while one of them admits such an EMM and the other does not.

(Joint work—book of the same title—with Constantinos Kardaras.)

Bio:

Ioannis Karatzas is Eugene Higgins Professor of Applied Probability in the Department of Mathematics at Columbia University. He works and publishes in Probability, Stochastic Analysis, and their Applications. He has had a long-term association with the investment firm Intech at Princeton, where he serves as distinguished researcher.

We look forward to having you join us for the talk and refreshments. See attached poster for more details. Please mark your calendars.