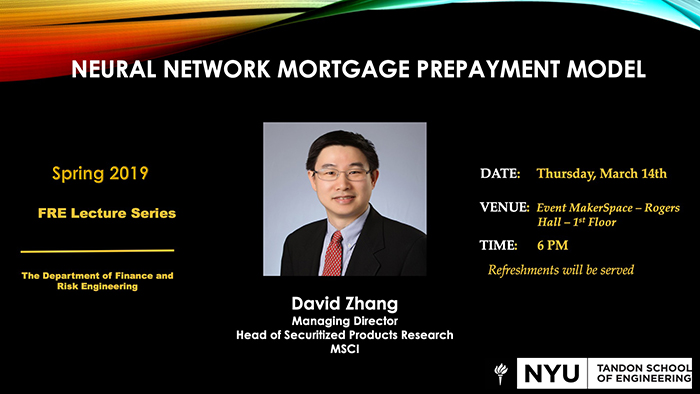

Talk with David Zhang

You are cordially invited to attend the upcoming FRE Lecture on

Thursday, March 14, 2019 at 6:00pm – 7:30pm

Event MakerSpace

6 MetroTech Center, 1st floor

Brooklyn, NY 11201

Dr. David Zhang will present a talk on the following topic:

Title:

Neural Network Mortgage Prepayment Model

Abstract:

We apply deep neural networks, a type of machine learning method, to model agency MBS 30-year fixed-rate pool prepayment behaviors. The neural networks model (“NNM”) is able to produce highly accurate model fits to the historical prepayment patterns, as well as accurate sensitivities to economic and pool-level risk factors. These results are comparable with model results and intuitions obtained from a traditional agency pool-level prepayment model that is in production and was built via many iterations of trial and error over many months and years. This example shows NNM can process large datasets efficiently, capture very complex prepayment patterns and model large groups of risk factors that are highly non-linear and interactive. We also examine various potential shortcomings of this approach, including non-transparency/“black box” issues, model overfitting and regime shift issues.

Bio:

David Zhang is a Managing Director and Head of Securitized Products Research at MSCI. His team is responsible for developing models and analytics to support investment analysis, risk management, and regulatory compliance.

Before joining MSCI, Dr. Zhang was Managing Director and head of Securitized Products modeling at Credit Suisse for more than a decade. At Credit Suisse he was responsible for supporting risk, regulatory and client analytics as well as sales/trading quantitative strategies. Dr. Zhang’s group developed one of the most widely used MBS models by fixed income institutional investors. Their work was consistently awarded top ranking by various industry and client surveys, including Institutional Investor All-America Research Team ranking in Agency prepayment. They also won the award for best paper by the American Real Estate Society for research on effectiveness of government mortgage programs

The regulatory projects Dr. Zhang lead at Credit Suisse included developing models for CCAR and PPNR (Pre-Provision Net revenue), Dodd-Frank IHC (Intermediate Holding Company) and related VaR, RWA and RBPL modeling, and FRTB (Fundamental Review of Trading Book).

Prior to Credit Suisse, Dr. Zhang worked at FreddieMac, CIBC Oppenheimer, and University of Chicago. He holds leadership positions at PRMIA (Professional Risk Management International Association) and GCREC (Global Chinese Real Estate Congress). He is a frequent speaker at industry and academic conferences, and his research on risk, financial modeling and real estate has been published in many academic journals. Dr. Zhang has a Ph.D. from Princeton University.

We look forward to having you join us next Thursday for the talk and refreshments. See attached poster for more details. Please mark your calendars.