Morton Topfer Chair Lecture - Dr. Lorne Switzer

Download the powerpoint file used in this lecture here.

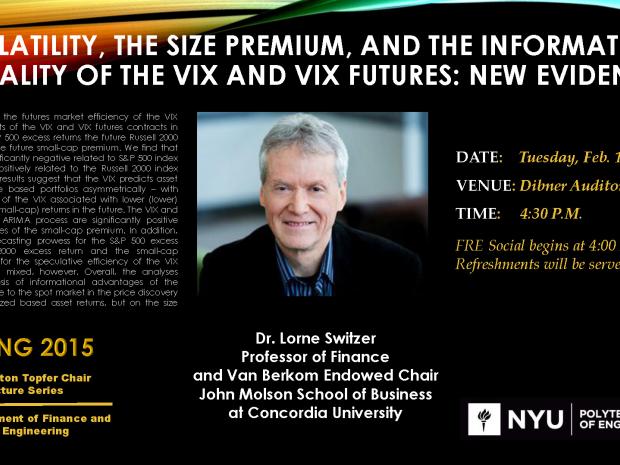

The Finance and Risk Engineering Department cordially invites you to attend the Morton Topfer Chair Lecture on Tuesday, February 17th in the Dibner Auditorium at 4:30PM.

Dr. Lorne Switzer, Professor of Finance and Van Berkom Endowed Chair at the John Molson School of Business, Concordia University, will present a talk on the topic of “Volatility, the Size Premium, and the Information Quality of the VIX and VIX Futures: New Evidence.”

Abstract:

This lecture examines the futures market efficiency of the VIX and the relative merits of the VIX and VIX futures contracts in forecasting future S&P 500 excess returns the future Russell 2000 excess returns, and the future small-cap premium. We find that the current VIX is significantly negative related to S&P 500 index excess returns and positively related to the Russell 2000 index excess returns. These results suggest that the VIX predicts asset returns based on size based portfolios asymmetrically – with higher (lower) values of the VIX associated with lower (lower) values of large-cap (small-cap) returns in the future. The VIX and VIX modeled by an ARIMA process are significantly positive related to future values of the small-cap premium.

In addition, VIX futures show forecasting prowess for the S&P 500 excess return, the Russell 2000 excess return and the small-cap premium.

The results for the speculative efficiency of the VIX futures contracts are mixed, however. Overall, the analyses support the hypothesis of informational advantages of the futures markets relative to the spot market in the price discovery process not just for sized based asset returns, but on the size premium as well.

Bio:

Lorne N. Switzer is a Professor of Finance and the Van Berkom Endowed Chair in Small Cap Equitiesand Associate Director of the Institute for Governance of Public and Private Organizations in the John Molson School of Business at Concordia University. He has published several academic articles in leading journals and serves on the Editorial Boards of European Financial Management, La Review Financier, the International Journal of Business, and the International Review of Economic Issues. He has done consulting work for many business firms and government organizations including the Bourse de Montréal., Caisse de Dépot et Placement du Québec, AMI Partners, Inc., Bank Credit Analysts Research Group, the CD Howe Institute, Keugler Kandestin LLC, Schlesinger, Newman, and Goldman, the Government of Canada,and the Gouvernement du Québec. He has won a number of research awards, including Best Paper Award, McMaster World Congress of Corporate Governance and the Bank of Canada Prize for Best Paper in the field of empirical research on Canadian Financial Markets at the Northern Finance Association Meetings. He is a graduate of the Wharton School of the University of Pennsylvania, and obtained his Ph.D. from the University of Pennsylvania in 1982.

Refreshments will be served at the FRE Social beginning at 4:00PM in the Dibner Foyer.