Abstract

Everyone knows that modern portfolio theory was born when economics graduate student Harry Markowitz sat in the University of Chicago library musing over the question, “Why don't investors put all their money in their best investment opportunity?” Around the same time, John Kelly at Bell Labs was asking the same question about horse race bettors. Kelly's answer is the foundation of modern financial risk management. Harry never met Kelly, although he published several papers about his work later; Kelly unfortunately died young. This talk will speculate about a counterfactual history in which the two met, and convinced each other of the validity of their insights. The inversion will help understanding both modern portfolio theory and modern financial risk management, and will lead to insights about the current economic environment.

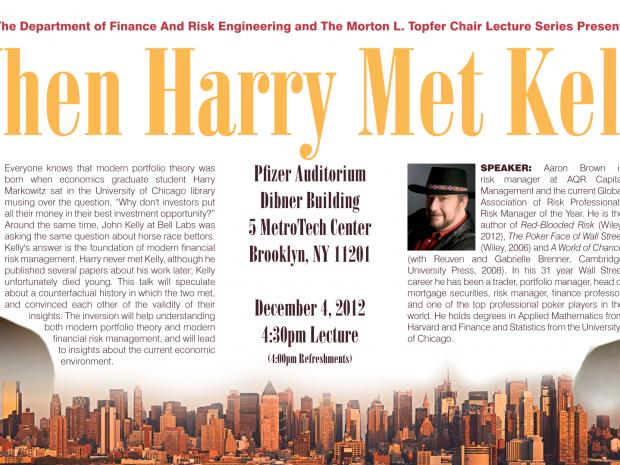

Bio

Aaron Brown is risk manager at AQR Capital Management and the current Global Association of Risk Professionals Risk Manager of the Year. He is the author of Red-Blooded Risk (Wiley, 2012), The Poker Face of Wall Street (Wiley, 2006) and A World of Chance (with Reuven and Gabrielle Brenner, Cambridge University Press, 2008). In his 31 year Wall Street career he has been a trader, portfolio manager, head of mortgage securities, risk manager, finance professor, and one of the top professional poker players in the world. He holds degrees in Applied Mathematics from Harvard and Finance and Statistics from the University of Chicago.