Parallel Processing for the Pricing of Financial Derivatives: Examples with SPX and SPY Options

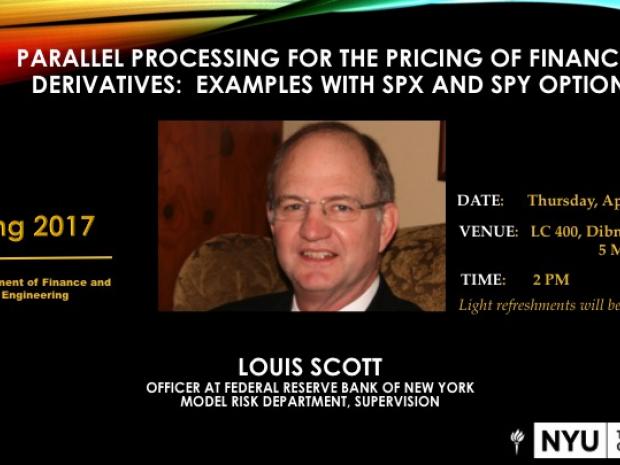

You are cordially invited to attend the FRE Lecture when Louis Scott, Officer in the Model Risk Department, Supervision at the Federal Reserve Bank of New York will present a lecture on the following topic:

Parallel Processing for the Pricing of Financial Derivatives: Examples with SPX and SPY Options

Abstract

Recent developments in computing technology coupled with massive parallel processing have opened the way forward for significant advances in artificial intelligence, robotics, and driverless cars. This same technology can be exploited for use in financial models. In this seminar, I will present first an overview of massive parallel processing on general purpose graphical processing units (aka GPU’s) and how this technology is being applied for financial models. This overview will be followed by a specific application to SPX and SPY options using a model with stochastic volatility and jump processes. The model for the stock price index and its stochastic volatility is based on an empirical analysis of the data, and does not lead to convenient closed form or quasi closed form solutions. Two standard solution techniques will be presented: a Monte Carlo solution and a finite difference solution to the partial differential integral equation, both implemented on GPU’s. I will include some performance tests (computing time tests) and a calibration of the model for both SPX and SPY options. The Monte Carlo solution is applied to the SPX options, which have European style exercise. The SPY options are options on the SPY ETF which have American style exercise and should be solved with a grid based method.

Bio

Louis Scott is currently at the Federal Reserve Bank of New York, where he is an Officer in the Model Risk Department, Supervision. Prior to joining the Fed in 2014, he was in the investment banking industry for 17 years where he was a Managing Director with Morgan Stanley and UBS. He held a variety of positions with responsibilities in risk management and quantitative research. He was a university professor in Finance at the University of Illinois and the University of Georgia and published academic research, including papers on derivative pricing. He has also served as an adjunct professor at the Courant Institute - NYU, and the Graduate Business School at Fordham University. His undergraduate degree is in Electrical Engineering from Duke University, and he has an MBA in Finance from Tulane University and a Ph.D. in Economics from University of Virginia.

We look forward to seeing you there. Refreshments will be served. Please mark your calendars.