Uncloaking Campbell and Shiller’s CAPE: A Comprehensive Guide to its Construction and Use

Dear All,

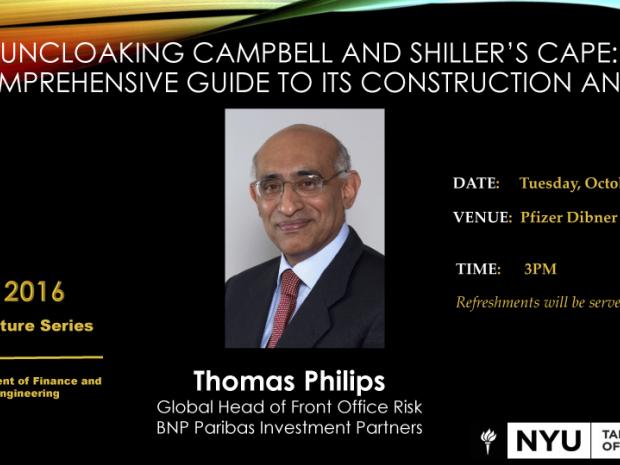

You are cordially invited to attend the upcoming lecture for Dr. Thomas Philips, Global Head of Front Office Risk, BNP Paribas Investment Partners:

Abstract:

Professors John Campbell and Robert Shiller’s Cyclically Adjusted Price-Earnings (CAPE) Ratio has proven to be a powerful descriptor, as well as a useful predictor, of long-term equity returns in the United States and some global markets. In recent years, though, it has been criticized for being overly pessimistic about the prospects for equity returns, its lack of robustness to distortions in corporate earnings, and for overstating the predictability of returns at long horizons on account of overlapping observations and endogeneity, particularly when estimated using Ordinary Least Squares (OLS).

Bio:

Thomas K. Philips, Ph.D. is the Global Head of Front Office Risk for the Institutional Division of BNP Paribas Investment Partners. He joined BNP Paribas Investment Partners from OTA Asset Management, a multi-strategy hedge fund in Purchase, NY, where he was Head of Investment Strategy and Risk Control. In that role, Mr. Philips oversaw a diverse set of hedge fund strategies and developed a number of tools, analytics and techniques to measure, monitor and control risk. Prior to joining OTA, he was Chief Investment Officer at Paradigm Asset Management, and a Managing Director at Rogers, Casey and Associates, where he had joint responsibilities in Research and in Alternative Investments. Earlier, Dr. Philips spent eight years at the IBM Corporation – his first five conducting research on problems in Operations Research, Computer Science and Applied Mathematics at the IBM Thomas J. Watson Research Center; and the last three at the IBM Retirement Fund. He has published over thirty articles on a wide range of topics in Finance, Engineering and Mathematics. In 2000, he received the first Bernstein / Fabozzi / Jacobs-Levy award for his paper “Why Do Valuation Ratios Forecast Long Run Equity Returns” which appeared in the Journal of Portfolio Management, and in 2008, he received the Graham and Dodd Scroll Award for his paper “Saving Social Security: A Better Approach”, which appeared in the Financial Analysts Journal. Dr. Philips received his Ph.D. in Electrical and Computer Engineering from the University of Massachusetts at Amherst, where he was elected a fellow of the graduate school and also elected to Tau Beta Pi.

Refreshments will be served.