Short Maturity Asian Options in Local Volatility Models

Dear All,

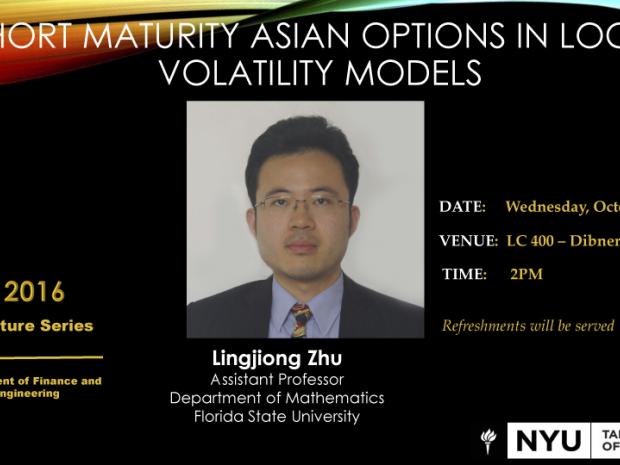

You are cordially invited to attend the upcoming lecture for Dr. Lingjiong Zhu, Assistant Professor in the Department of Mathematics at Florida State University:

Abstract:

We present a rigorous study of the short maturity asymptotics for Asian options with continuous-time averaging, under the assumption

that the underlying asset follows a local volatility model. The asymptotics for OTM and ATM cases are derived. The asymptotics for the OTM

case involves a non-trivial variational problem which is solved completely. We present an analytical approximation for Asian options

prices, and demonstrate good numerical agreement of the asymptotic results with the results of Monte Carlo simulations and benchmark test cases in

the Black-Scholes model for option parameters relevant in practical applications. This is based on the joint work with Dan Pirjol.

Bio:

Lingjiong Zhu grew up in Shanghai and went to study in England, where he got BA from University of Cambridge in 2008. He then moved to the

United States and received PhD from New York University in 2013. After a stint at Morgan Stanley, he went to work at University of Minnesota as

Dunham Jackson Assistant Professor, before joining the faculty at Florida State University as an Assistant Professor in 2015.

Refreshments will be served.