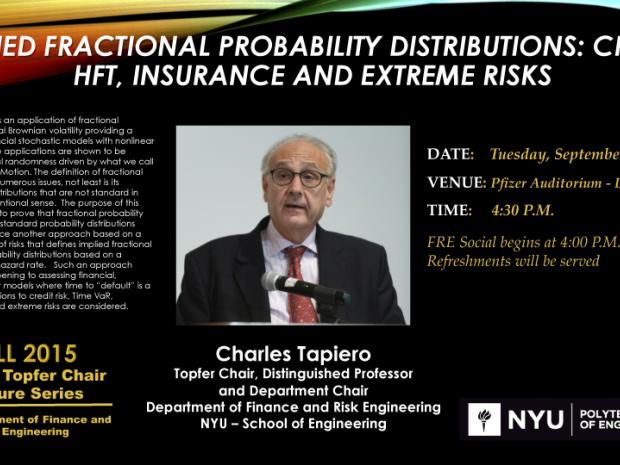

Implied Fractional Probability Distributions: Credit, HFT, Insurance and Extreme Risks

With Professor Charles Tapiero, department chair, Department of Finance and Risk Engineering

Fractional Finance is an application of fractional calculus to Fractional Brownian volatility providing a richer family of financial stochastic models with nonlinear time volatility. These applications are shown to be based on a financial randomness driven by what we call fractional Brownian-Motion. The definition of fractional randomness raises numerous issues, not least is its defining random distributions that are not standard in the statistical conventional sense. The purpose of this talk is two folds, first to prove that fractional probability distributions are not standard probability distributions and second introduce another approach based on a temporal definition of risks that defines implied fractional and standard probability distributions based on a random time—the hazard rate. Such an approach provides another opening to assessing financial, insurance and other models where time to “default” is a fractional. Applications to credit risk, Time VaR, insurance claims and extreme risks are considered.

FRE social begins at 4pm.

Refreshments will be served.